It is interesting to note that through this economic crisis everyone missed the root cause of the world wide economic collapse. What is the root cause of the global economic contraction? We tend to blame things that are intuitive like banks, Wall Street and private business layoffs but they are all symptoms. Financial Markets are the prime target because we associate dollars with the economy, as we should, but they are symptomatic of a much larger crisis. A crisis that we have to articulate before we can solve it. Einstein said that if he had one hour to save the world he would spend fifty-five minutes defining the problem and only five minutes finding the solution. This quote illustrates an important point: before jumping to conclusions regarding the economic meltdown, we must step back and invest time and effort to determine the real problem within the economy.

US banks, AIG or any other financial institution could not have caused an economic collapse of global proportion. The banks were second to the auto industry to feel the economic contraction. What common worldwide resource could have caused this crisis. At the time of the economic collapse late 2008 oil was tipping the scale at $130/bbl. The only thing that can cause a WW collapse is a WW inelastic commodity that is powerful enough to affect all countries WW. I beleive that the smoking gun is OIL.

Everything in life has an energy component (cost) associated with it--food, fuel, electricity, water, production, etc. People use disposal (fungible) income to meet small periodic swings in energy cost, but when the short term volatility of energy swings more than 20% and stays there for several months, people and businesses have to make hard choices. Do I pay for gasoline to get to work or run my process or deliver my product, do I put food on the table, do I keep the electric and water on, do I pay my credit cards, my home loans ...? At first they begin to borrow (take from Peter to pay Paul) and that works for a short period but at the end of the day after making these choices and runnning up the debt, those on the margin (large debt to equity ratios) did not have sufficient money remaining to pay the mortgage, or the car payment, or the credit cards, and the financial markets reacted as delinquincies mounted.

The result, I believe appeared to the neophyte that it was the banking and financial market who were at fault. We blamed 0 interest loans, brokers, etc. But I submit to you that they were only the tipping point, they were the first after automotive to see the train wreck coming. As soon as energy prices fell, the economy began its slow recovery. In my small mind, I am convinced that the cause of the economic collapse was volatile (out of control) energy costs of the past 8 years. At the time of the economic collapse, oil was heading above $130.00/barrel. And, it is not over by any stretch. Oil prices have topped $90.00/bbl last week and they continue to rise.

If energy does not stay below $75.00 per barrel the economy will not recover on its own. We will see a second 2012 contraction. With higher prices will come additional economic burden and a contracting rather than expanding economy will result. Energy Drives the Economy, Period.

Last edited by GPaulus; 02-01-2011 at 06:59 AM.

Hardly. For one, many symptoms can be traced back to the financial issues.

Second, several nations have taxes on energy/oil that led to an effective market price higher than the one to be paid in the U.S. today. These other countries would have entered the crisis decades ago - but some of them are doing fine even today.

I pay 1.5€ per litre gasoline. That's 5.7 €/gallon which in turn is 7.8 US-$/gallon, for example. U.S. retail price: 3.1 US-$.

My country - Germany - is doing fine, albeit there's still a slight loss of growth to catch up to.

It makes more sense to look at the roots of the financial crisis in order to identify a bigger truth than just the symptom. I don't mean a political or law-wise look, but a macroeconomic look.

One could for example ask why the U.S. consumed and invested a fifth more goods before the crisis than it produced (after counting the small service trade balance surplus as goods production).

Meanwhile, resources were squandered on a colossal scale by building more houses than affordable, not pushing for energy efficiency, allowing the resource allocators in the financial sector to go mad and leech on the whole economy, neglecting infrastructure, spending much on the military, keeping up an incredibly inefficient and deficient healthcare system and maintaining a third world level of income inequality.

A crash was predictable, unavoidable - and the roots for this are still in existence, so there'll be another crash (or a long suffering) in this decade.

We may have to agree to disagree on this one. I am not saying that higher energy prices will collapse an economy but what I am saying is that Volatile

Energy Prices will collapse an economy. Energy in the economy is "normalized" and products, transportation construction etc can adjust to inflationary (controlled) price increases because energy is in the baseline of their price for the product. But when 20 - 30 % swings occur or the prices climb too fast, the markets cannot react quickly enough. The result is usually double digit inflation. This time things were quite different and extranalities controlled inflation. The result was a deflation in the economy, a collapse.

Given enough time and stable energy pricing, the economy will recover.

Last edited by davidbfpo; 02-02-2011 at 09:03 AM. Reason: Fix quote

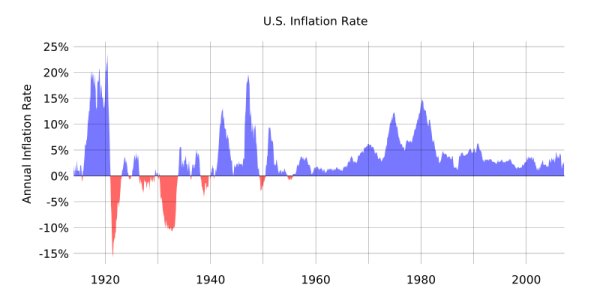

Show me your "double digit inflation".

I have yet to see a statistic showing such a thing for an economy because of oil price hikes.

Hint: The consumption of energy isn't a large-enough share in any country's economy to produce double-digit inflation.

U.S. inflation rate has been single digit in this crisis.

The only periods in time energy prices became really volatile were in 1974/75oil embargo (quick and short duration) follow by 12% inflation, and 1980/81. follow by deregulation and again inflation. Since that time energy as a commodity has dropped except 1998/2000 Enron and 2006,7,8 OPEC. In the early 1990s we had some of the lowest normalized energy rates in our history and the economy took off. This time things were very different, the FEDs introduced extranalities into the economy, lowering interest rates to compensate and to thwart inflation. Priming the engine with massive stimulus money/projects.

The result of volatile enegy was an implosion and a contraction of the economy and everything lost value. That started an economic collapse and downward spiral --business cut jobs, production of non-essential products ceased, housing dropped, car industry slumped, people on the margin failed to pay their loans, credit cards, utilities, and foreclosures occurred. The banks and credit card companies became the bad guys. But, they were a symptom! And it will happen again if energy continues to move at a rate greater than the inflation rate. In November oil was $77 and now it is 95. How can that be? A 20% increase. Has oil demand risen by 20 percent?

The very question already shows that you have no clue about economic theory. The correct question would have asked for the price elasticity of demand for oil. That's 1st or 2nd semester microeconomics.

You asserted

and the graph proves you wrong. There was no double digit inflation in decades despite such crude oil price spikes.But when 20 - 30 % swings occur or the prices climb too fast, the markets cannot react quickly enough. The result is usually double digit inflation.

Earlier spikes of the inflation coincide with world wars (and their aftershocks) and earlier recessions (which happen to involve high crude oil prices).

A global or a national economy has many more variables than energy cost and inflation rate. Federal reserve bank policies allowed high inflation (not this time) in the 70's, but not this time. In fact, there were huge deflation tendencies which were counteracted by expansionary federal reserve bank policies - the end result was a moderate inflation.

The whole link between energy costs and overall inflation/economic crisis is rather weak and indirect. Other variables can easily overcompensate the link.

The increasing energy costs of the mid-2000's did not help, but they're not the root of the global economic crisis. Likewise, subprime mortgages and CDOs were merely symptoms.

The crisis was a a correction movement against unsustainable imbalances with lots of secondary effects.

A high crude oil price is easily sustainable, as evidenced by the fact that some economies already pay a high price for crude oil products due to high crude oil-specific taxation.

The corrections of unsustainable imbalances happened at the weak spot of obviously unsustainable resource mis-allocations; distorted housing sectors (market price bubbles). Secondary effects rippled through an unproductive financial sector which had grossly neglected the management of systemic risks.

Finally, financial sector problems and their bandaging led to the fiscal de facto collapse of several states (Iceland and Ireland experienced economic nightmares because of out-of-proportion financial sectors, Greece/Portugal experience(d) fiscal nightmares because of unsustainable fiscal deficits).

High oil prices alone would merely have sufficed to challenge the viability of some products/business models and have caused some adaption processes in economies. In worst case, some countries would have felt a substantial change in terms of trade - comparable in aggregate effect to a changed rate of currency exchange. That's what we saw in 73/74.

Our economic crisis looked VERY differently this time.

Gentlemen,Originally Posted by Fuchs

Market fundamentals are less and issue than index speculation, which has driven a premium of 15% by conservative estimates, to as high as 50%. NYMEX recorded record net long positions in crude futures and options. Its paper, just like it was in 2008.

There have been several posts and links in other threads about record commodity prices from excessive speculation.

Note: I should add that chapter four in Matt Taibbi’s book Griftopia explains the 2008 commodities bubble in the simplest terms possible. Taibbi does a superb job of explaining complex financial, political, and economic issues to the lay-reader, with remarkably less vulgarity. This book should be required reading for every American.

Last edited by bourbon; 02-05-2011 at 10:31 PM. Reason: To add note/recommendation

Presley, Your right it is not a science (it used to be known as a Discipline,whatever that means?) but some Economist can and do make predictable,testable arguments. This is a link to one below. We have 2 and only 2 ways to fix the Economy that is the whole tool set. As the link below will point out.

http://prospect.org/cs/articles?arti...doesnt_matter#

Economists do scientific research because their methods are scientific (unlike alchemists' methods*). The scientific results are statements about probabilities, not about exact outcomes (even physics ceased in to claim that it can do more in many cases). These probabilities can be tested and be falsified if wrong.

I do not expect everyone to be an economist to understand that economics is a science, but I expect at the very least that those who attempt to deny economics the status of a science do know what a science is.

Furthermore, I expect that no activity that has encompassed two centuries and ten thousands of people be ignored, such as ignoring the huge activity in regard to making testable predictions and testing them.

http://en.wikipedia.org/wiki/Science...lassificationsScientific fields are commonly divided into two major groups: natural sciences, which study natural phenomena (including biological life), and social sciences, which study human behavior and societies. These groupings are empirical sciences, which means the knowledge must be based on observable phenomena and capable of being tested for its validity by other researchers working under the same conditions.

*: Guilt by association, a fairly dirty rhetorical trick. Well, at least it's more sophisticated than outright ignorance about the real world (of economic research).

Alchemists employed formalism, observation and experiment--the three methods of scientific inquiry. What they did not do was produce testable predictions that hold up under scrutiny; electing instead to issue either blatantly incorrect forecasts or more often incomprehensibly qualified handwaving.

Natural scientists were deploying probability to the problems of fluids, thermodynamics and the subatomic when economists and social "scientists" were still hemming and hawing dialectics. What you have today is the sorry marriage between statisticians feeding results to mumblers squinting to something real in the numbers. It's slightly more elegant numerology.The scientific results are statements about probabilities, not about exact outcomes (even physics ceased in to claim that it can do more in many cases).

1. Outside of a very few narrow areas, they can't. There's no laboratory to achieve the repetition necessary generate the sample space. The inspiring signal is of limited value beyond backcasting and useless in generating new, testable predictions.These probabilities can be tested and be falsified if wrong.

2. Even if 1) weren't the case, I'd love to see a SINGLE, verified economic forecast pegged within the 95 percent confidence interval that doesn't sweep the range of mutually exclusive possibilities with near uniform probability. Seriously, we ask less of meteorologists.

And there's your challenge, Fuchs. Simply point me to 2) and you will have demonstrated economics has at least produced a single scientific result.

PH Cannady

Correlate Systems

I love it when positivists or more specifically absolutists grab hold of the empirical method and what big "T" truths might exist.

The expectation that economists have to explain "EVERYTHING" to be relevant towards "ANYTHING" is pretty defatigable. This is especially true when you bring in the tool of economists, which is statistics, which is a relevant sample, of a relevant population, giving a relative solution, to a falsifiable proposition (hypothesis).

In other words. In forcing a discipline into a box they've never claimed you injure the relevant position by a claim they've never made. A handy logical straw man or circumlocution.

I needn't remind this audience that empiricism is made up of many different schools of thought and have existed for much longer than the ad hominem of windowed time relating to recent political discourse. The Popper and Kuhn dichotomy means that science has just as many partisan ignominies as Fox and CNN do political pundits.

Regardless of the witchcraft that economists might use. The enlightened scientific philosopher will understand that empiricism and epistemology exist as holistic set of principles with the swinging tides of rational thought pulling upon each thread. The scientific method is many tools not just one.

Last edited by selil; 02-22-2011 at 10:22 PM.

Sam Liles

Selil Blog

Don't forget to duck Secret Squirrel

The scholarship of teaching and learning results in equal hatred from latte leftists and cappuccino conservatives.

All opinions are mine and may or may not reflect those of my employer depending on the chance it might affect funding, politics, or the setting of the sun. As such these are my opinions you can get your own.

Oh, my bar is set far lower than that. I'm asking for economists to explain--or more accurately, correctly predict--ANYTHING about SOMETHING.

No argument here. A number of veterans here eat modelers and number crunchers for breakfast, yet clearly we've confidence in their authority on what works and what doesn't. That said, an economist isn't a seasoned fighter dropping his experience on what and what doesn't work. Instead, he puts forward the pretense of theory, issuing lengthy "explanations" yet predicting nothing.Regardless of the witchcraft that economists might use. The enlightened scientific philosopher will understand that empiricism and epistemology exist as holistic set of principles with the swinging tides of rational thought pulling upon each thread. The scientific method is many tools not just one.

Last edited by Presley Cannady; 02-22-2011 at 10:33 PM.

PH Cannady

Correlate Systems

My example is of ONE economist and ONE theory that I think explains quite well a lot of things. Vilfredo Pareto and the 80/20 rule or Pareto principle. Not only statistically relevant (think sigma) it is relevant to daily life and significant in explaining many things from software to kids grades.

Sam Liles

Selil Blog

Don't forget to duck Secret Squirrel

The scholarship of teaching and learning results in equal hatred from latte leftists and cappuccino conservatives.

All opinions are mine and may or may not reflect those of my employer depending on the chance it might affect funding, politics, or the setting of the sun. As such these are my opinions you can get your own.

This is not a scientific debate, we don't have the time and resources for a prediction and waiting for it to happen.

For all else, read a peer-reviewed economic science journal.

There are thousands of relatively simple economic rules that easily meet highest empirical standards, especially under experimental or ceteris paribus conditions.

Some of them have even the robustness of natural laws, such as the observation that deficits are not sustainable or the inevitability of market failures under certain conditions. There's for example not a single known commercial unemployment insurance in the world (due to two especially severe market failures, excluding con artist endeavours).

Finally, there are even hundreds of management rules that can be proved (and were proved) with math just like math rules themselves, for example rules for optimising production under known conditions.

Economic science is a science, it's understood and defined as such. Those who doubt it can feel free to prove it, but they are powerless feeble voices against the existing definition of the meaning, sound and graphic of the word "science".

They can't argue that economic science is no science without ignoring the real-world business of ten thousands of economic researchers.

This stupid questioning whether economic science is a true science always leaves an impression about the questioner on me that's probably beyond the forum etiquette. Those people simply do not grasp social sciences, and certainly don't seem to attempt it.

Sure, some (or many) economists are no scientists at all, many have forgotten what they were taught about scientific work. There are lots of loudmouths who proclaim a lot of economic nonsense. Clueless people can see those loudmouths and make the mistake t believe that they were representative. Fact is, even natural sciences have such loudmouth (see cold fusion).

There are furthermore more economists than natural scientists in contact with a wide public audience and it's especially easy to earn good money with being a loudmouth as economist in comparison with being one as physicist.

This whole strain of the discussion is moot, and off-topic, of course. Even if economist s were not working scientifically, they would still be the best experts around for explaining "How to fix the economy".

Economics-bashing is thus futile.

The topic is "how to fix the economy." Surely we should entertain the notion that the OP is nonsense. How do you fix something you no one knows how to fix?

As opposed to a peer-reviewed ufology or astrology journal? Peer review is but one tool for gatekeeping a body of knowledge, and not nearly the most important one.For all else, read a peer-reviewed economic science journal.

Then it should be simple to name one genuinely economic "rule" that holds under scrutiny, as opposed to listing off some rather simple observations as you do below.There are thousands of relatively simple economic rules that easily meet highest empirical standards, especially under experimental or ceteris paribus conditions.

Neither one of those qualifies as testable statements. Both assert a point of divergence in the unbounded future, rendering it impossible to present evidence to the contrary gathered from past to present. The second suffers in that it doesn't even specify causation. Surely an asteroid strike would cause a market failure; is astronomy now the province of economics?Some of them have even the robustness of natural laws, such as the observation that deficits are not sustainable or the inevitability of market failures under certain conditions.

Setting aside what is or isn't a con, surely you jest.There's for example not a single known commercial unemployment insurance in the world (due to two especially severe market failures, excluding con artist endeavours).

Math is the formal expression of an idea. The difference between math expressing physical nonsense and physical reality are laws constraining its application. Without laws of thermodynamics, energy conditions for general relativity, or quantum inequalities, physics devolves into free for all. These laws actually produce testable results that coincide with measured reality. To date, the social sciences have produced no analogous constraints--either generally or conditionally.Finally, there are even hundreds of management rules that can be proved (and were proved) with math just like math rules themselves, for example rules for optimising production under known conditions.

It's not the burden of the skeptic to "prove" economics is scientific anymore than it is the burden of any reasonable man to admit astrology absent evidence.Economic science is a science, it's understood and defined as such. Those who doubt it can feel free to prove it...

There are billions of men and women who work day in and day out on unscientific pursuits.They can't argue that economic science is no science without ignoring the real-world business of ten thousands of economic researchers.

Attempt what? Solving ordinary differential equations? Regression? Reducing sparse matrices? Crunching expected value and variance? These tools are used far more frequently and effectively outside of the social sciences than within. Hell, they're usually built, extended and maintained by people from the hard side of the tracks.This stupid questioning whether economic science is a true science always leaves an impression about the questioner on me that's probably beyond the forum etiquette. Those people simply do not grasp social sciences, and certainly don't seem to attempt it.

What I find disappointing is that economists invest so much time learning the unholy mess of gadgetry they've accumulated that little is spent determining whether or not their toolkit applies to the problems they're trying to solve. Their first hint should've been the century and a half wasted formalizing any intuition they could lay their hands on while producing not one verifiable result. Their second should've been after even the fire marshal industry started to clean up its act.

If your point is that scientists make mistakes, then you're understating it considerably. We can't even compare the body of rejected hypotheses to those that bear fruit. The point is that science provides the tools for rejecting those hypotheses in the first place and coming to agreement on those that work.Sure, some (or many) economists are no scientists at all, many have forgotten what they were taught about scientific work. There are lots of loudmouths who proclaim a lot of economic nonsense. Clueless people can see those loudmouths and make the mistake t believe that they were representative. Fact is, even natural sciences have such loudmouth (see cold fusion).

I have to disagree, and I'll do so redirecting you to the question I presented at the beginning of this post. How do you fix the economy if no one knows how to fix it?This whole strain of the discussion is moot, and off-topic, of course. Even if economist s were not working scientifically, they would still be the best experts around for explaining "How to fix the economy".

Economics-bashing is thus futile.

My answer is when in doubt, unleash your countrymen to research and experiment freely. Should any policy or law erected on the alchemy of social science interfere, eject it. Then wait and see.

PH Cannady

Correlate Systems

I believe you that you have no clue how to fix the economy and you don't know who knows. I'm also confident that the latter is closely related to your cluelessness about how to identify people who know how to fix the economy, and likewise I'm confident that you have no clue about economic science.

There's no one individual who knows everything about how to fix the economy because the topic is too big and complex, but there are many (actually many thousands) who have a good clue about many of the necessary measures (especially the big ones).

Macroeconomics is too difficult and abstract for popular media, though. This leaves many people clueless about economics and allows for a huge collection about stupid ideas about economies. Financial market-oriented reporting of mass media adds to the cluelessness and confusion.

I studied economic science for several years at a West German university, focused on macroeconomics, have a degree on it and I know enough economic theories* and papers to know that this stuff is science.

I knew about how the Euro zone will run into the exact troubles of today before the € was introduced because economic scientists had worked on the necessary theories back in the early 90's (each one for every advantage or disadvantage of monetary unions), because my professors had told me about those theories and because the micro experiment of monetary union in re-unified Germany was already supporting those theories.

Meanwhile the public - including those who disparage(d) economic science - had no clue about it.

Making more use of economic science would improve policy a lot. (As of today, lawyers are more influential in policy than economists are - and it shows.)

This reaches from big things like the current crisis or monetary unions down to negotiating simple treaties (the OECD standard form for double taxation treaties is distorted by lobbyists, for example - but only economists will be able to tell you what's the problem in it).

You don't want to see economic theory as science and this keeps you from seeing it as such. I'm happy that most people in power seem to see it as a science and politicians make use of it at least when political gaming allows for it.

Feel free to live on in a fantasy world where your re-defining of the world works. That doesn't help anyone in this world.

*: There was a time when I learned one or two new theories per 90 minute lecture. Economic theories happen to explain one thing a piece.

Oh, btw, I will tell the physicists that they shall never again call Newtonian Physics "science" because they're only "simple observations", and some guy on the internet meant that this doesn't count as science. Or I won't.

Bookmarks