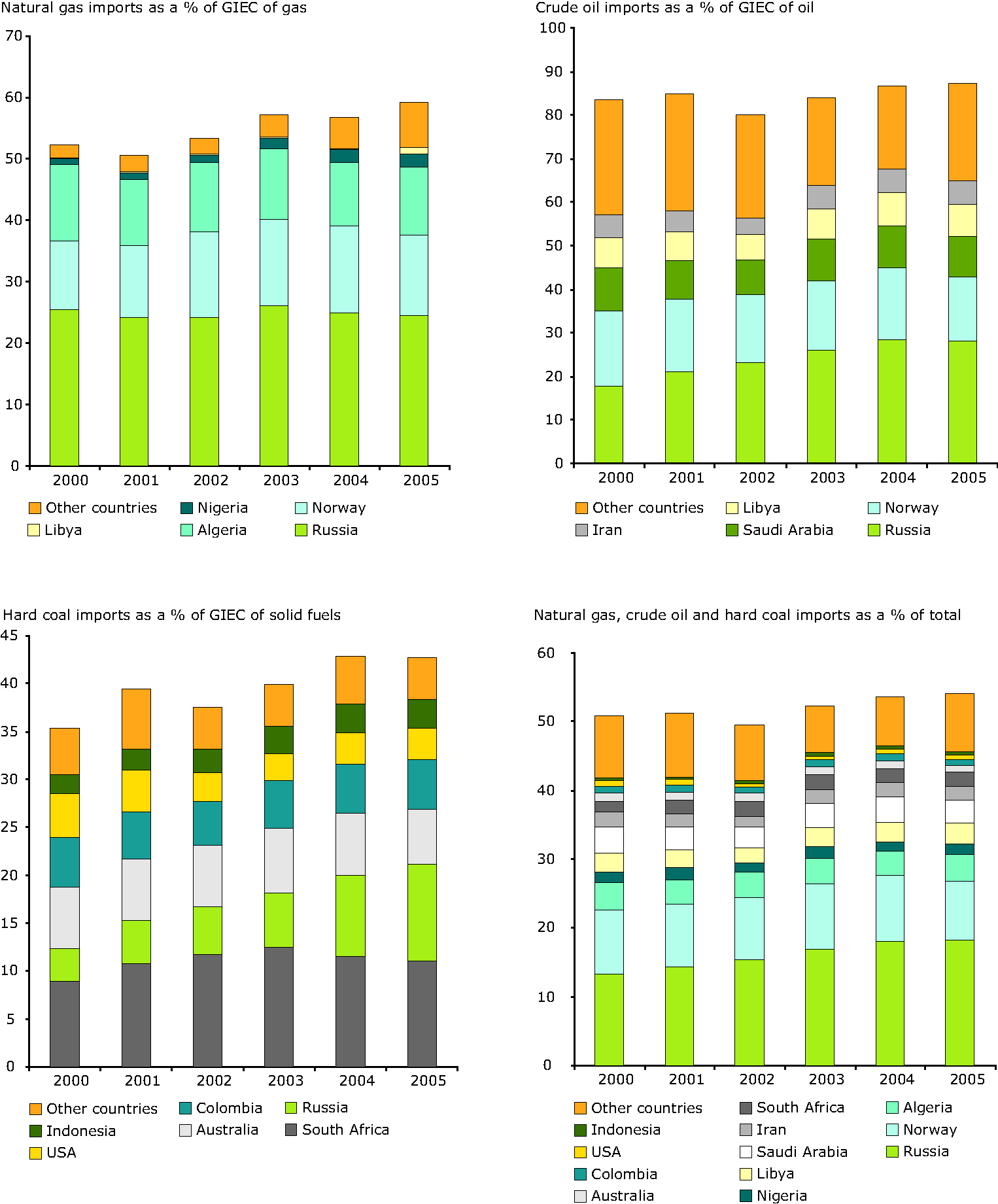

Thanks for catching that error, what was I thinking? As I stated before coal imports can substitute natural gas imports and indeed they do to some degree. Obviously in the short-term is limited by the existing infrastructure along along chain, but it is very important to state the obvious, as I often do. Things get more elastic with time of course...

Demand:

Supply:

Of course part of those coal imports are, especially in the eastern European countries, from the same sources as the NG and oil....

Reply With Quote

Reply With Quote

Bookmarks