Well I do focus more on the sinews of war, not the political conflict:

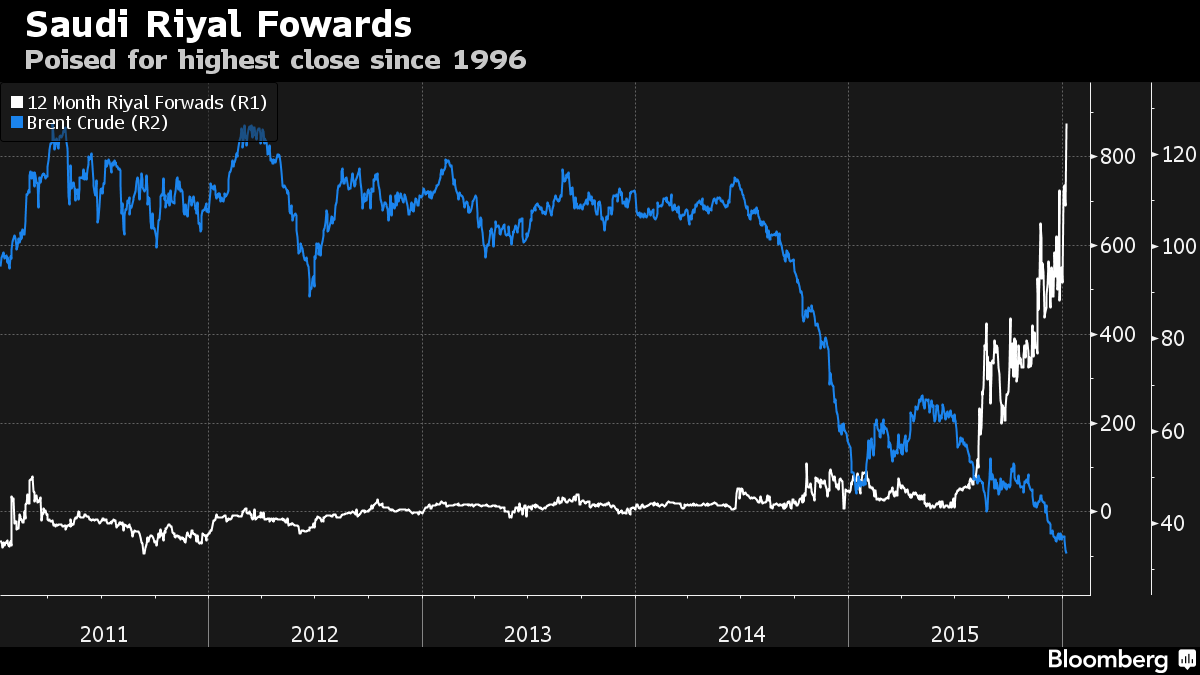

Contracts used to bet whether Saudi Arabia will allow its dollar-pegged currency to weaken were poised for the highest level in almost two decades as oil prices plummeted.

Twelve-month forward contracts for the riyal climbed 260 points to 950 as of 3:49 p.m. in Riyadh, set for the steepest close since December 1996, when Bloomberg began collecting the data. That reflects growing speculation the world’s biggest oil exporter may allow its currency to slide against the dollar for the first time since 1986.

A picture can say sometimes more then a hundred words...

In this context the previously unthinkable to most seems now possible to some: "Saudi Arabia Is Considering Aramco IPO, Deputy Crown Prince Says"

An IPO will certainly be done in a way that Saudi Arabia de-jure and de-facto still controlls Aramco. Of course like many things it would have been smarter to make such moves in good times but buy high and sell low seems to be the motto of many a miner or driller, public, private or state-owned.“Personally, I’m enthusiastic about this step,” [Deputy Crown Prince] Salman said.

Saudi Aramco produces all of Saudi Arabia’s crude oil, at 10.25 million barrels a day in December. Among listed companies, Russia’s OAO Rosneft produces more than 5 million barrels a day while Exxon Mobil Corp. pumps out about 4 million barrels.

Reply With Quote

Reply With Quote

Bookmarks