Latest James Galbraith Interview from Bloomberg. Until you fix the Banks nothing will change.

http://www.bloomberg.com/video/62193196/

Latest James Galbraith Interview from Bloomberg. Until you fix the Banks nothing will change.

http://www.bloomberg.com/video/62193196/

Economics is alchemy with a cheaper tool box.

PH Cannady

Correlate Systems

It is interesting to note that through this economic crisis everyone missed the root cause of the world wide economic collapse. What is the root cause of the global economic contraction? We tend to blame things that are intuitive like banks, Wall Street and private business layoffs but they are all symptoms. Financial Markets are the prime target because we associate dollars with the economy, as we should, but they are symptomatic of a much larger crisis. A crisis that we have to articulate before we can solve it. Einstein said that if he had one hour to save the world he would spend fifty-five minutes defining the problem and only five minutes finding the solution. This quote illustrates an important point: before jumping to conclusions regarding the economic meltdown, we must step back and invest time and effort to determine the real problem within the economy.

US banks, AIG or any other financial institution could not have caused an economic collapse of global proportion. The banks were second to the auto industry to feel the economic contraction. What common worldwide resource could have caused this crisis. At the time of the economic collapse late 2008 oil was tipping the scale at $130/bbl. The only thing that can cause a WW collapse is a WW inelastic commodity that is powerful enough to affect all countries WW. I beleive that the smoking gun is OIL.

Everything in life has an energy component (cost) associated with it--food, fuel, electricity, water, production, etc. People use disposal (fungible) income to meet small periodic swings in energy cost, but when the short term volatility of energy swings more than 20% and stays there for several months, people and businesses have to make hard choices. Do I pay for gasoline to get to work or run my process or deliver my product, do I put food on the table, do I keep the electric and water on, do I pay my credit cards, my home loans ...? At first they begin to borrow (take from Peter to pay Paul) and that works for a short period but at the end of the day after making these choices and runnning up the debt, those on the margin (large debt to equity ratios) did not have sufficient money remaining to pay the mortgage, or the car payment, or the credit cards, and the financial markets reacted as delinquincies mounted.

The result, I believe appeared to the neophyte that it was the banking and financial market who were at fault. We blamed 0 interest loans, brokers, etc. But I submit to you that they were only the tipping point, they were the first after automotive to see the train wreck coming. As soon as energy prices fell, the economy began its slow recovery. In my small mind, I am convinced that the cause of the economic collapse was volatile (out of control) energy costs of the past 8 years. At the time of the economic collapse, oil was heading above $130.00/barrel. And, it is not over by any stretch. Oil prices have topped $90.00/bbl last week and they continue to rise.

If energy does not stay below $75.00 per barrel the economy will not recover on its own. We will see a second 2012 contraction. With higher prices will come additional economic burden and a contracting rather than expanding economy will result. Energy Drives the Economy, Period.

Last edited by GPaulus; 02-01-2011 at 06:59 AM.

Hardly. For one, many symptoms can be traced back to the financial issues.

Second, several nations have taxes on energy/oil that led to an effective market price higher than the one to be paid in the U.S. today. These other countries would have entered the crisis decades ago - but some of them are doing fine even today.

I pay 1.5€ per litre gasoline. That's 5.7 €/gallon which in turn is 7.8 US-$/gallon, for example. U.S. retail price: 3.1 US-$.

My country - Germany - is doing fine, albeit there's still a slight loss of growth to catch up to.

It makes more sense to look at the roots of the financial crisis in order to identify a bigger truth than just the symptom. I don't mean a political or law-wise look, but a macroeconomic look.

One could for example ask why the U.S. consumed and invested a fifth more goods before the crisis than it produced (after counting the small service trade balance surplus as goods production).

Meanwhile, resources were squandered on a colossal scale by building more houses than affordable, not pushing for energy efficiency, allowing the resource allocators in the financial sector to go mad and leech on the whole economy, neglecting infrastructure, spending much on the military, keeping up an incredibly inefficient and deficient healthcare system and maintaining a third world level of income inequality.

A crash was predictable, unavoidable - and the roots for this are still in existence, so there'll be another crash (or a long suffering) in this decade.

We may have to agree to disagree on this one. I am not saying that higher energy prices will collapse an economy but what I am saying is that Volatile

Energy Prices will collapse an economy. Energy in the economy is "normalized" and products, transportation construction etc can adjust to inflationary (controlled) price increases because energy is in the baseline of their price for the product. But when 20 - 30 % swings occur or the prices climb too fast, the markets cannot react quickly enough. The result is usually double digit inflation. This time things were quite different and extranalities controlled inflation. The result was a deflation in the economy, a collapse.

Given enough time and stable energy pricing, the economy will recover.

Last edited by davidbfpo; 02-02-2011 at 09:03 AM. Reason: Fix quote

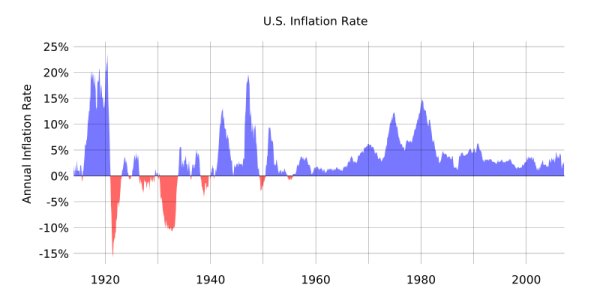

Show me your "double digit inflation".

I have yet to see a statistic showing such a thing for an economy because of oil price hikes.

Hint: The consumption of energy isn't a large-enough share in any country's economy to produce double-digit inflation.

U.S. inflation rate has been single digit in this crisis.

Presley, Your right it is not a science (it used to be known as a Discipline,whatever that means?) but some Economist can and do make predictable,testable arguments. This is a link to one below. We have 2 and only 2 ways to fix the Economy that is the whole tool set. As the link below will point out.

http://prospect.org/cs/articles?arti...doesnt_matter#

Economists do scientific research because their methods are scientific (unlike alchemists' methods*). The scientific results are statements about probabilities, not about exact outcomes (even physics ceased in to claim that it can do more in many cases). These probabilities can be tested and be falsified if wrong.

I do not expect everyone to be an economist to understand that economics is a science, but I expect at the very least that those who attempt to deny economics the status of a science do know what a science is.

Furthermore, I expect that no activity that has encompassed two centuries and ten thousands of people be ignored, such as ignoring the huge activity in regard to making testable predictions and testing them.

http://en.wikipedia.org/wiki/Science...lassificationsScientific fields are commonly divided into two major groups: natural sciences, which study natural phenomena (including biological life), and social sciences, which study human behavior and societies. These groupings are empirical sciences, which means the knowledge must be based on observable phenomena and capable of being tested for its validity by other researchers working under the same conditions.

*: Guilt by association, a fairly dirty rhetorical trick. Well, at least it's more sophisticated than outright ignorance about the real world (of economic research).

Alchemists employed formalism, observation and experiment--the three methods of scientific inquiry. What they did not do was produce testable predictions that hold up under scrutiny; electing instead to issue either blatantly incorrect forecasts or more often incomprehensibly qualified handwaving.

Natural scientists were deploying probability to the problems of fluids, thermodynamics and the subatomic when economists and social "scientists" were still hemming and hawing dialectics. What you have today is the sorry marriage between statisticians feeding results to mumblers squinting to something real in the numbers. It's slightly more elegant numerology.The scientific results are statements about probabilities, not about exact outcomes (even physics ceased in to claim that it can do more in many cases).

1. Outside of a very few narrow areas, they can't. There's no laboratory to achieve the repetition necessary generate the sample space. The inspiring signal is of limited value beyond backcasting and useless in generating new, testable predictions.These probabilities can be tested and be falsified if wrong.

2. Even if 1) weren't the case, I'd love to see a SINGLE, verified economic forecast pegged within the 95 percent confidence interval that doesn't sweep the range of mutually exclusive possibilities with near uniform probability. Seriously, we ask less of meteorologists.

And there's your challenge, Fuchs. Simply point me to 2) and you will have demonstrated economics has at least produced a single scientific result.

PH Cannady

Correlate Systems

I love it when positivists or more specifically absolutists grab hold of the empirical method and what big "T" truths might exist.

The expectation that economists have to explain "EVERYTHING" to be relevant towards "ANYTHING" is pretty defatigable. This is especially true when you bring in the tool of economists, which is statistics, which is a relevant sample, of a relevant population, giving a relative solution, to a falsifiable proposition (hypothesis).

In other words. In forcing a discipline into a box they've never claimed you injure the relevant position by a claim they've never made. A handy logical straw man or circumlocution.

I needn't remind this audience that empiricism is made up of many different schools of thought and have existed for much longer than the ad hominem of windowed time relating to recent political discourse. The Popper and Kuhn dichotomy means that science has just as many partisan ignominies as Fox and CNN do political pundits.

Regardless of the witchcraft that economists might use. The enlightened scientific philosopher will understand that empiricism and epistemology exist as holistic set of principles with the swinging tides of rational thought pulling upon each thread. The scientific method is many tools not just one.

Last edited by selil; 02-22-2011 at 10:22 PM.

Sam Liles

Selil Blog

Don't forget to duck Secret Squirrel

The scholarship of teaching and learning results in equal hatred from latte leftists and cappuccino conservatives.

All opinions are mine and may or may not reflect those of my employer depending on the chance it might affect funding, politics, or the setting of the sun. As such these are my opinions you can get your own.

This is not a scientific debate, we don't have the time and resources for a prediction and waiting for it to happen.

For all else, read a peer-reviewed economic science journal.

There are thousands of relatively simple economic rules that easily meet highest empirical standards, especially under experimental or ceteris paribus conditions.

Some of them have even the robustness of natural laws, such as the observation that deficits are not sustainable or the inevitability of market failures under certain conditions. There's for example not a single known commercial unemployment insurance in the world (due to two especially severe market failures, excluding con artist endeavours).

Finally, there are even hundreds of management rules that can be proved (and were proved) with math just like math rules themselves, for example rules for optimising production under known conditions.

Economic science is a science, it's understood and defined as such. Those who doubt it can feel free to prove it, but they are powerless feeble voices against the existing definition of the meaning, sound and graphic of the word "science".

They can't argue that economic science is no science without ignoring the real-world business of ten thousands of economic researchers.

This stupid questioning whether economic science is a true science always leaves an impression about the questioner on me that's probably beyond the forum etiquette. Those people simply do not grasp social sciences, and certainly don't seem to attempt it.

Sure, some (or many) economists are no scientists at all, many have forgotten what they were taught about scientific work. There are lots of loudmouths who proclaim a lot of economic nonsense. Clueless people can see those loudmouths and make the mistake t believe that they were representative. Fact is, even natural sciences have such loudmouth (see cold fusion).

There are furthermore more economists than natural scientists in contact with a wide public audience and it's especially easy to earn good money with being a loudmouth as economist in comparison with being one as physicist.

This whole strain of the discussion is moot, and off-topic, of course. Even if economist s were not working scientifically, they would still be the best experts around for explaining "How to fix the economy".

Economics-bashing is thus futile.

Bookmarks